When your business has grown to a certain scale, listing is one of the main options to put a market value to your shares and take your business to the next level.

An initial public offering (IPO) is more than a capital raising and liquidity activity. It also raises the public profile of your business.

However, a hasty move to list a business with poor planning and execution may end up in you spending more effort and getting less reward. As listing is an important milestone in your company’s history, it should not be taken lightly.

How TLP Can Help With Your IPO

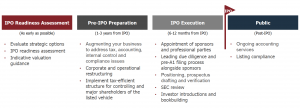

The IPO execution process takes place 6-12 months before the IPO. In the case of a Hong Kong IPO, this is when you hire sponsors.

However, the IPO preparation process needs to take place years before that. Businesses need to supplement their accounting, internal control and legal functions. This is where TLP comes into play.

We augment your business’ finance function and work closely with auditors and your counsel to resolve financial, taxation, legal, internal control and restructuring issues.

IPO Readiness Assessment

We perform an IPO readiness assessment to figure out if your business is ready for an IPO. If you would like to discuss your business, feel free to reach out to us here.